Quantum AI

Loan decision engine powered by Salesforce Einstein artificial intelligence for rapid and accurate loan application decisions.

Highly accurate loan predictions

Integrated eSignature, open banking and SMS

Learns from your own data

How it works

Quantum AI utilises the financial institutions customer loan portfolio book and supporting financial services inputs from Open Banking & Credit Referencing Agencies (CRAs) to determine loan decisions efficiently and effectively.

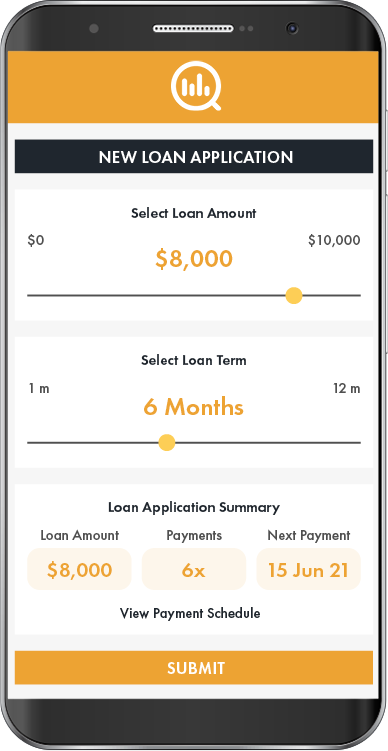

Application

An applicant fills out your custom loan application form online

Credit Score

The application checks third-party services for credit score reports and identity verification

AI Prediction

We use artificial intelligence to score this applicant to similiar past applicants using your own data

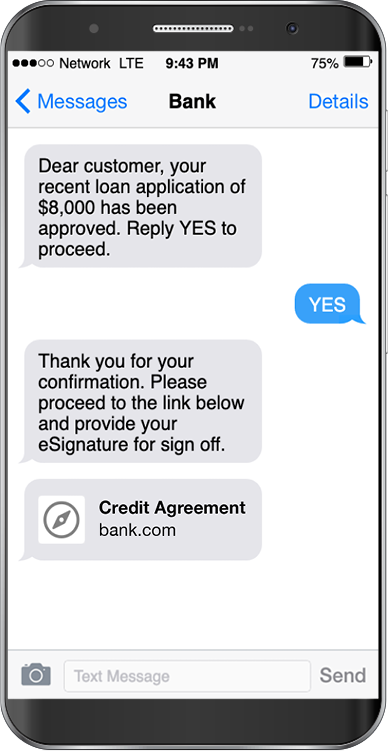

Notification

The applicant is notified they have been approved with a SMS offer within seconds

eSignature

The accepts the loan agreement using eSignature verification from their phone

Apply online

Use our custom built forms to guide borrowers through the application process

Mobile or desktop ready

Pre-fill forms using your data

Secure application forms

Artificial intelligence loan decision engine

Approved in minutes

Automate your approval process using AI to find the right borrowers

Text message approval notifications

eSignature and credit checking

Reduce manual review time

Lending intelligence

Quantum AI utilises the financial institutions customer loan portfolio book and supporting financial services inputs from Open Banking & Credit Referencing Agencies (CRAs) to determine loan decisions efficiently and effectively.

Get in touch with us

Let's set up a time to discuss how we can help you.

Explore the benefits

With self-service analytics, you can instantly slice and dice data on any device, without waiting for IT or analysts.

Automation

Improve your operational efficiency by utilising Process Builder to automate your Loan Decision workflow. From loan application to electronic sign offs.

Open Banking

Connect with Open Banking & Credit Referencing Agencies (CRAs) to access credit scoring and other detailed financial information of your customer.

Core Agnostic

Quantum AI is designed to work with your existing core system. Simply provide Quantum AI secure access to your data and setup is complete.

Accurate Loan Prediction

Quantum AI is highly accurate and has achieved a prediction rate of 92.7% so you can achieve a substantial increase in operational efficiency and savings.

Lightning-Fast Prediction

Get accurate and lightning-fast loan predictions within seconds as Quantum AI executes multiple decision flows to identify trends and patterns based on historical data and loan parameters.

Greater Efficiency

With Quantum AI’s flexible decoupled technology architecture and intelligent automation system , you can achieve greater efficiency and reduction in operational costs with minimal overhead costs.